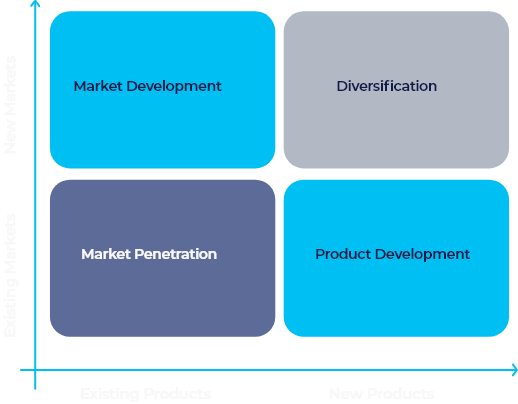

Growth

+ future M&A

At 3Capital Partners, we understand that companies face a series of challenges in their performance and expansion trajectory, which require course adjustments in strategy and operations.

Our founder, Claus Vieira, with his 33 years of experience as CEO of medium and large companies, combined with his extensive history of M&A transactions, has successfully led several Growth processes, supporting companies in implementing strategic changes and tactics in customization projects for value-added solutions that combine our extensive management know-how, aiming to maximize value and prepare companies for future M&A.